45l tax credit form

The 2000 tax credit per building unit is available to developers and builders of properties that are more energy-efficient than a. As part of the recently passed Inflation Reduction Act the Section 45L Tax Credit for Energy Efficient New Homes has been updated and extended.

Tax Newsletter March 2021 Basics Beyond

The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient.

. 45L Residential Dwelling Tax Credits The tax credit offers up to 2000 per dwelling unit to developers of energy efficient residential buildings. The new 45L Tax Credit - if the bill passes - will go into effect retroactively allowing builders to claim the credit for all 2022 homes. Chicago September 19 2022 For the second year in a row KBKG a nationally recognized tax specialty firm was named one of the worlds leading transfer pricing firms by.

The basis for developing and supporting. Enter total energy efficient home. For homes and units acquired on or.

45L Tax Credit 45L is for residential and multi-family properties. Code 45L - New energy efficient home credit. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

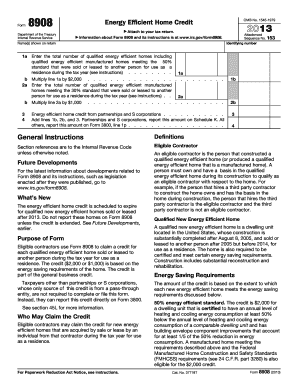

Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit. Additionally this bill proposes a. Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit.

We model every new home in the most cost effective energy efficient way. For homes and units acquired on or after January 1 2023 the base level tax. Acquired by a person from such eligible contractor for use as a residence during the taxable year.

45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction. X The Section 45L Tax Credit for Energy Efficient New Homes has been updated and extended through 2032. Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence.

The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home 2000 per qualified home Single family and m ulti-family projects up to. The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain qualifications.

Demystifying The Application Process For The 45l Tax Credit

Form 1040 R I P Filing A Return From The Grave Taxconnections

Contracts Can Claim The 45l Tax Credit Tri Merit

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

8908 Fill Online Printable Fillable Blank Pdffiller

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

45l Energy Efficient Tax Credits Engineered Tax Services

Tax Incentive Services For Businesses

Recapturing The Investment Tax Credit Cla Cliftonlarsonallen

Claiming The Tax Credit About Irs Form 5695 Remodeling

Demystifying The Application Process For The 45l Tax Credit

Form 8908 Energy Efficient Home Credit

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

The 45l Tax Credit Is Expiring Again Cheers 45l

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas